The Home Buyer’s Corner

California home loans & home buying explained

Should I Use an FHA Loan or a Conventional Loan in California?

Published on: 17/02/2026

FHA and conventional loans both have pros and cons. Learn how credit score, down payment, and mortgage insurance affect which option makes more sense.

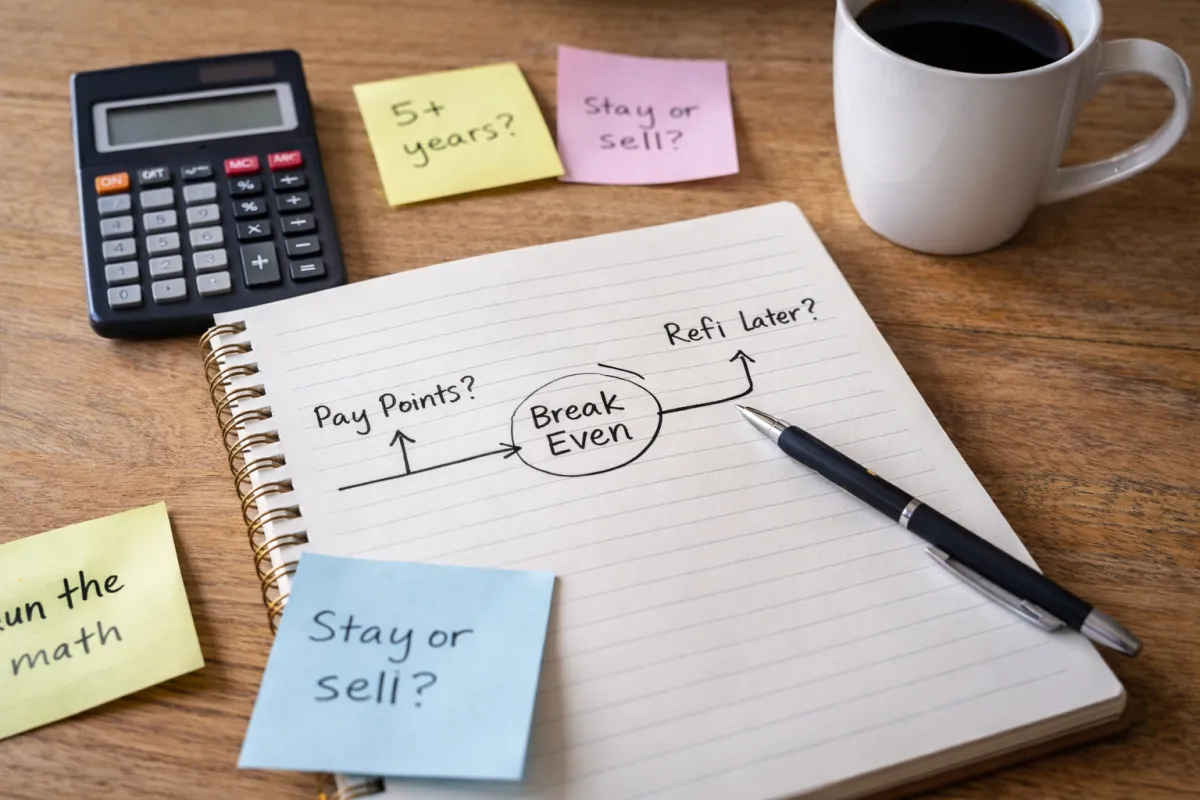

Should I Pay Points on My Mortgage in California?

Published on: 13/02/2026

Paying points can lower your rate, but it only makes sense if you keep the loan long enough. Learn how break-even works and when points are worth it.

If I Buy a House Now & Rates Drop Later, How Soon Can I Refinance?

Published on: 11/02/2026

Most buyers can refinance as soon as it makes sense. Learn how prepayment penalties work, how to calculate break-even, and when refinancing is worth it.

Do My Student Loans Stop Me From Qualifying for a House in California?

Published on: 11/02/2026

Worried student loans prevent you from buying? This article explains how lenders actually calculate student loans and how buyers still qualify in California.